Postponing just makes it even worse. Yet you likewise don't intend to get on the first deal after a failure. The vehicle insurance coverage negotiation will certainly be as reduced as they can make it, and you might need to combat to get what you really need. Keeping that in mind, to the finest of your ability, try to accumulate proof after the crash to sustain your claim.

If you're close enough to a location you understand and also count on, have it lugged there to save time. low cost auto. The only means to recognize after a complete loss that your cars and truck insurance policy settlement is reasonable is to look up that worth yourself.

Do not forget to note any kind of enhancements you've made that can affect your completed vehicle's value. If you still owe cash on the cars and truck, discover the specific quantity you have superior. There may quite possibly be a balance left over, especially if you obtained the car loan lately, as the ACV is typically reduced than what you owe since of devaluation.

However, it may not be so precise that's at mistake, as well as you may require to confirm to the insurer that the various other chauffeur was responsible. low cost auto. That might take a long time time you do not have if you need immediate medical treatment or need to secure transportation after your automobile was amounted to.

trucks liability insured car cars

trucks liability insured car cars

You also have the choice of submitting a personal injury legal action against the at-fault driver to obtain compensation in this way. Total-loss laws in Oklahoma Oklahoma is an at-fault state, so the insurer of the driver who created the wreckage (thinking they're guaranteed according to state law) is intended to spend for losses of the various other vehicle drivers associated with the mishap.

How Vehicle Total Loss - Farm Bureau Insurance Of Michigan can Save You Time, Stress, and Money.

This coverage enables you to pay the market price for a brand-new replacement auto in the exact same class as the total-loss car (affordable auto insurance). Lots of vehicle drivers do not have this option, though, since the premiums on these type of plans can be substantially greater than basic car insurance. As well as it's clear why when you get a regular total-loss vehicle insurance negotiation based upon ACV.

Not straight, at the very least. What might occur, though, is that the hill of expenses that accumulate later can ravage your credit rating Helpful resources if they don't make money (low-cost auto insurance). Overdue medical and also car repair work costs, fundings that need to be paid, added car loans that require to be secured all can be ruining.

Whether you really feel that amount is fair or otherwise is another issue. car insured. Right here's the trouble: if you have a funding or lease out on a completed auto, you're still accountable for paying off the remaining balance. Generally, the insurance provider pays the lending institution or tenant first and provides you the remainder of the settlement cash if there's any surplus.

If you have thorough and crash coverage, you might have sufficient insurance policy to pay off the car loan. affordable auto insurance. You might not have actually enough left over to repay the funding and also buy a brand-new auto, however you ought to a minimum of have a sizable down-payment. Automobile insurance plan can be intricate and also confusing.

Remember the statute of restrictions for submitting a lawsuit following an automobile crash in New York is three years, however it's best to begin collaborating with a legislation company immediately, while the proof is fresh. automobile.

The Basic Principles Of Michigan's Auto Insurance Law Has Changed - State Of ...

If you have actually lately been in an auto mishap, and your insurance company has established that your lorry is a total loss, you still might be able to bring your vehicle house before it strikes the salvage lawn. The huge concern to ask on your own, nevertheless, is whether you really wish to keep it.

Generally, a completed auto is given a salvage title, and afterwards the insurance firm pays you the value of the vehicle as well as auctions it off for its salvage value. You can pick to maintain an overall loss lorry instead if you desire to fix it or restore its parts on your own - insure.

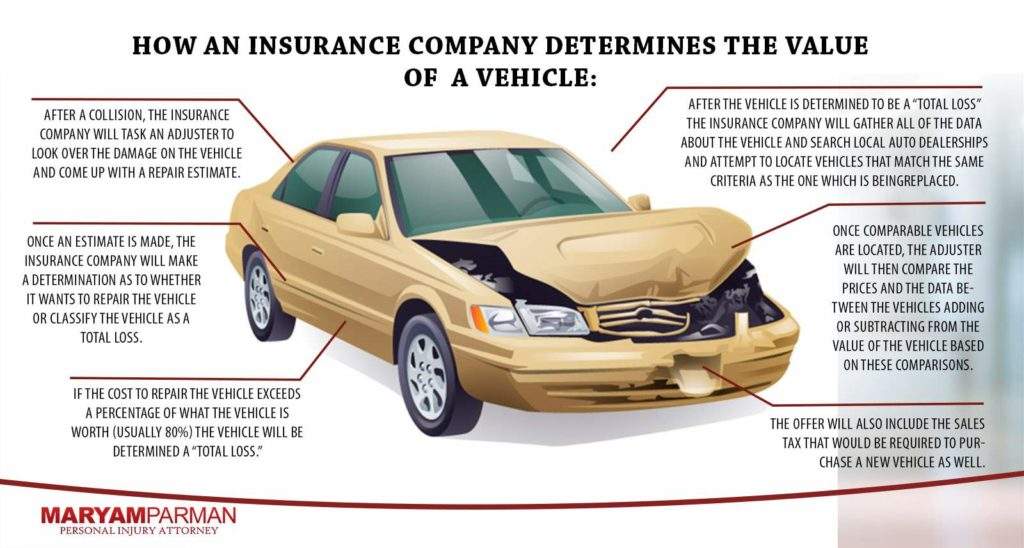

What Is a Total Loss? Insurance coverage suppliers tag automobiles as failures if the expense of fixings is greater than the worth of the lorry at the time of the mishap. Details definitions can differ from one state to another and from insurance firm to insurance firm. If your insurer chooses that the damage to your auto is so considerable that it can not be fixed safely, it will be regarded a total loss, cost factors to consider apart.

You could be right, yet take into consideration a few factors prior to making your choice. Repair service Costs This is the big one. If the insurance provider does not assume repair work are worth it, you need to make certain that you can obtain actual worth out of the vehicle. If you are not a specialist technician, make certain to obtain the point of view of one.

A completed automobile is a threat to you as well as various other drivers if not properly fixed. Passing Examination You might encounter difficulty obtaining your state's department of automobile to authorize the repair services as well as re-brand the title as a "rebuilt." You will need to obtain your fixed vehicle evaluated, and also if the state won't sign off, you will not be able to drive your auto on public roads - vans.

The Basic Principles Of When Your Vehicle Is A Total Loss - Infoassurance.ca

If you are worried that you may owe greater than your car is worth if it becomes totaled, you should consider space insurance, which will certainly cover the difference for you. Resale Worth A salvage title decreases the resale value of your car by 20% to 40% or even a lot more.

State Rule Depending on where you live, your state laws might not also allow you to maintain an amounted to vehicle. insurance company. Your agent will certainly know the neighborhood policies about whether keeping the vehicle is also an alternative for you. If You Still Want to Keep Your Car If you still can not birth to component with it, and also your state doesn't stop it, you must have the ability to concern a plan with your insurance company to keep your lovely accident.

Frequently Asked Concerns (Frequently asked questions) How much time will insurance coverage pay for a rental automobile after an overall loss? The length of time you can rent out an automobile depends upon your insurance coverage. You can usually establish the amounts and also restrictions of rental cars and truck coverage when you originally established your plan or make any type of modifications to it.

This post details what takes place when you still owe cash on an amounted to cars and truck. What Is a Totaled Vehicle? A "completed" cars and truck is one that a automobile insurance coverage business chooses is a "total loss." Lots of states established a threshold for when an insurer need to total an auto. For instance, state regulation could need an insurance company to complete a car when the cost to fix it is greater than 75% of the auto's ACV.

insure cheaper car cheaper cars cheaper car

insure cheaper car cheaper cars cheaper car

If the complete loss threshold in your state is evaluated 75%, your insurer will certainly complete your cars and truck because it'll cost greater than $7,500 to fix. However if an auto mechanic can repair your vehicle for $5,000, your insurance provider will likely repay you for the cost to repair it. Obtain the fundamentals on automobile insurance policy and repair choices after a mishap.

Everything about What Happens If Insurance Totals Your Car - Campinghiking.net

But the insurance firm will certainly subtract the salvage worth of the cars and truck (what they would certainly have obtained for it from a junkyard) from your negotiation. The "complete loss" designation will certainly be part of your auto's automobile background as well as you might have a difficult time signing up, insuring, as well as selling the automobile in the future.

An amounted to automobile isn't drivable. credit score. If you choose to keep and also repair your amounted to vehicle, you'll likely need to obtain a rebuilt title from your state's division of motor vehicles and also insurance before you can lawfully drive it. Getting insurance policy with a rebuilt title is possible, yet not easy. Some insurers won't cover rebuilt vehicles in all, others offer liability protection only.

What Takes place When You Still Owe Money on a Totaled Cars and truck? If your vehicle is amounted to after a crash and you haven't settled your finance, your options will usually depend on: what type of car insurance you have (consisting of gap insurance policy) your car's real money value (ACV), as well as how much you owe on your vehicle loan (affordable car insurance).

credit score cheap automobile cheaper cars

credit score cheap automobile cheaper cars

The coverage your lending institution needs could not be enough when your vehicle is amounted to. Because insurance policy business don't care concerning exactly how much you owe on your funding. They only payout your automobile's ACV at the time of the accident (cheap).

cheaper car insurance cars auto insurance

cheaper car insurance cars auto insurance

Let's claim you spin out as well as struck a stop indication. Your car is totaled. The insurance policy firm says your vehicle's ACV is $8,000, however you still owe $10,000 on your loan. The insurance firm will certainly cut your lender a look for $8,000. You still have to pay the remaining $2,000 on your lending, despite the fact that your vehicle is damaged.

The Facts About When Insurance Totals Your Car - Louisville Accident & Injury ... Uncovered

If your auto's ACV is $8,000 as well as you owe $2,000, the insurer will certainly pay your loan provider $2,000 and you $6,000 (insurance). For tips on what to do if you disagree with the insurer's evaluation of your car, take a look at: The Insurer States My Cars And Truck is a Failure, What Currently? If You Don't Have Insurance policy Driving without insurance coverage or other proof of monetary capability is illegal in many states.

If you do total your financed vehicle in an crash while you do not have automobile insurance coverage, you will need to remain to make lending settlements till your lending is settled. You will likewise have to spend for all accident-related expenditures (clinical bills, building damages) expense. If the crash involves an additional motorist or another person's property, you may get filed a claim against.

If The Various other Vehicle driver Is at Mistake Let's claim a car rear-ends you at a stoplight. Whether you're dealing with the various other motorist's insurance business or your very own, an insurance provider will just pay out the ACV for a completed cars and truck - auto insurance.

Insurers just pay out the fair market price (ACV) of a car on the day of the crash. As an example, let's say you drop off to sleep at the wheel and also hit a guardrail. Thanks to your air bags, you're okay, but your cars and truck is amounted to. You have full insurance coverage, consisting of crash as well as comprehensive.

You can usually purchase gap protection with your auto loan lender or insurance provider. Void insurance policy isn't affordable and also you need it only when you owe greater than your cars and truck's well worth. Void insurance might be worth having if you: place little or no cash down for your automobile obtained a lending for longer than a couple of years drive greater than the ordinary individual, or got a vehicle that sheds worth swiftly.

The 10-Minute Rule for When Your Vehicle Is A Total Loss - Infoassurance.ca

The insurance firm says the ACV of your car is $25,000, yet you still owe $35,000 on your lending. Void insurance coverage can cover the $10,000 distinction between your automobile lending equilibrium and also insurance settlement check. suvs. What Void Insurance Doesn't Cover Void insurance coverage just begins when your car is a failure because of an accident or burglary.

Things don't constantly work out that method when you finance your automobile. What do you do when you complete your car as well as you're upside down on your car loan? If you do not have void insurance policy to cover the distinction in between your failure negotiation and also your finance balance, you can try to negotiate with the insurance company.

You can repay your financing and make use of the remainder of the negotiation cash to buy a new vehicle. Worst situation circumstance: Your complete loss insurance settlement is less than your finance equilibrium as well as you have no void insurance policy. You are stuck to a completed auto you can't drive and a cars and truck repayment till the lending is repaid. accident.