Our leading 5 picks for the very best cars and truck insurance are USAA, Geico, State Ranch, Progressive and also Travelers. # USAA: Reduced Prices for Military Standard price: $Number of price cuts: 12Usage-based insurance coverage: Safe, Pilot, TM in 37 states USAA is our front runner for the very best cars and truck insurance in the country - risks. It consistently tops J.D.

dui auto cheap insurance cheap car insurance

dui auto cheap insurance cheap car insurance

It offers the least expensive vehicle insurance coverage usually contrasted to any various other supplier we looked into. Our rate price quotes show excellent vehicle drivers pay about generally for complete coverage cars and truck insurance policy with USAA. The firm likewise uses discounts based on driver safety, numerous plans, security features such as airbags as well as even more.

Our price quotes show that motorists pay around on standard for full coverage auto insurance from Geico. Our price quotes put Geico in the top three firms for price contrasted to various other nationwide service providers.

Past the standard sorts of protection, State Ranch offers: Emergency situation roadway service coverage Auto leasing as well as travel costs protection Rideshare motorist coverage Our price price quotes show great chauffeurs pay approximately about for complete coverage insurance with State Farm. This rates State Ranch amongst the most economical national suppliers - cheapest car insurance.

According to the NAIC, State Ranch accounted for 15. 93% of the car insurance market share in 2021. State Farm additionally had fewer problems than the sector standard in 2020, though customer testimonials on the BBB are combined. We selected State Farm as one of the country's finest automobile insurer in component due to the usage-based and also safe driving discounts it uses to young drivers.

Our 2022 car insurance study located 74% of Dynamic policyholders are pleased with their coverage. Progressive additionally offers solid financial security, with an A+ rating from AM Ideal. The firm likewise wrote greater than $35 billion in premiums in 2021, according to the NAIC. Our group got to out to Progressive for a comment on its negative evaluation scores yet did not get an action.

The 20-Second Trick For How Important Is Car Insurance? - Phoneswiki

In the J.D. Power Car Insurance Policy Study, Travelers scored listed below the section average in virtually every area other than New York. Our team reached out to Travelers for a talk about its unfavorable testimonial ratings but did not obtain a reaction. According to our study, Travelers insurance pricing is a little less costly than the nationwide average, costing $1,617 each year typically for a complete coverage policy.

You can find out much more in our full Travelers insurance policy review.

insurance cheapest cheapest auto insurance affordable

insurance cheapest cheapest auto insurance affordable

Power overall cases complete satisfaction ranking: N/An Alternative ideal vehicle insurer for young vehicle drivers: State Ranch If you're a young driver, after that you might not desire an insurance provider tracking your driving habits. Because case, you must seek an insurance provider that has a tendency to have reduced prices for young chauffeurs (cheap auto insurance).

They won't all penalize you to the same degree. Farm Bureau elevates prices by 34% when chauffeurs have an at-fault crash in their recent background 6% less than standard. Using prices drew from around the nation, we found that Farm Bureau only boosts rates by $534 per year for a full protection policy after an accident.

Product presented is believed to be from trusted resources as well as no representations are made by our company as to another events' informational precision or efficiency. All information or concepts provided must be talked about in detail with an advisor, accountant or lawful counsel prior to implementation.

Unless otherwise suggested, using 3rd event trademarks here does not imply or suggest any kind of partnership, sponsorship, or endorsement in between Excellent Monetary Cents as well as the proprietors of those trademarks. Any type of referral in this web site to 3rd party hallmarks is to determine the equivalent 3rd party goods and/or services - cars.

Not known Facts About Healthcare.gov: Get 2022 Health Coverage. Health Insurance ...

Last Judgment Vehicle insurance policy for teenagers and also university student can be pricey, and possibly confusing to buy. Fortunately is that several insurance provider supply price cuts and various other methods to aid youths save while getting the insurance coverage they require. Supplying a compelling general bundle of cost, opportunities to conserve, ease of usage, and also monetary stability, State Ranch is our option for the finest general auto insurance policy for teens as well as university student - prices.

cheap auto insurance cheaper car insurance insure cheapest

cheap auto insurance cheaper car insurance insure cheapest

In some instances, moms and dads might think that they restrict their responsibility if their youngster has their very own policy, yet insurance experts recommend this might not hold true (vehicle). Contrasting Automobile Insurance for Teens and also University student When purchasing for vehicle insurance policy for teens and university student, consider the list below variables:: Insuring a teen or college student can be costly, but prices vary amongst companies.

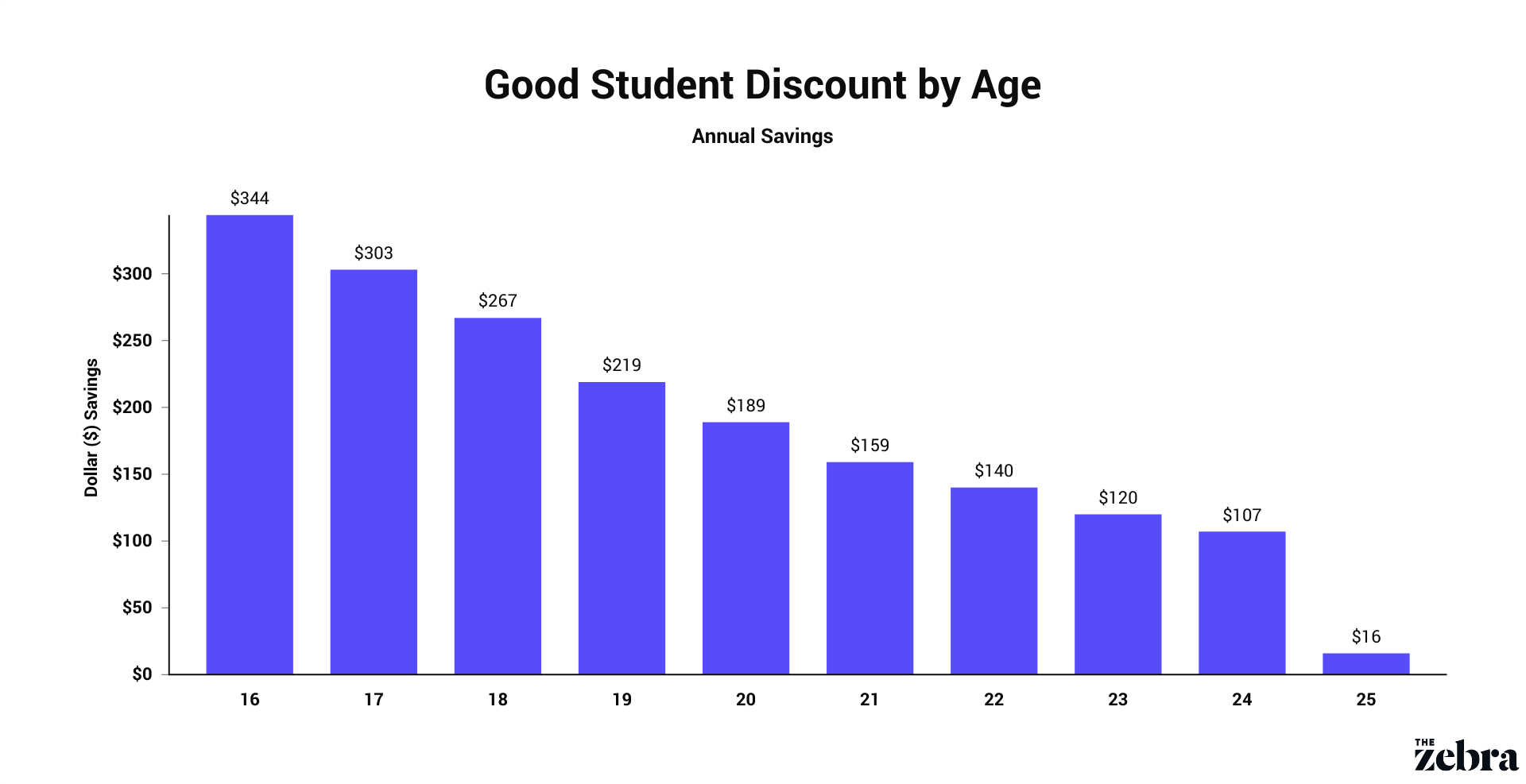

These commonly consist of discount rates for contending least a B average in college, for completing chauffeur training, or for being away at institution full time.: Liability insurance coverage is necessary in most states, while thorough, accident, and also void protection might be needed by the financial institution for a car with a car loan or lease. prices.

How Teenagers as well as College Pupils Can Buy Cars And Truck Insurance Coverage Coverage There are numerous methods for a teen or university student to acquire automobile insurance policy coverage.: An agent can supply individual service as well as recommendations tailored to the insurance coverage needs of teenagers as well as college students. Independent agents represent numerous firms and also can go shopping about on their customer's part to find the best mix of coverage, cost, and also price cuts.

While this option is offered 24/7, a drawback is that it offers little to no assistance on insurance coverages and also discounts.: Still an additional choice is for teenagers and college students to call an insurer directly by phone (car insured). Lots of have toll-free numbers attaching to firm reps that can assist with the plan quote as well as acquisition.

Just How Much Does Auto Insurance Coverage for Teenagers and also University Student Cost? Auto insurance for teens and university student is typically rather pricey. risks. In our survey of companies, the typical expense for insurance from big national service providers was $467 each month. Fortunately is that the majority of the business we researched deal multiple discount rates targeted to teens and university pupils, together with programs such as usage-based insurance policy that can aid vehicle drivers conserve.

8 Simple Techniques For 10 Best Car Insurance Companies Of 2022 - Wallethub

What Does Vehicle Insurance for Teenagers and also University Students Cover? An auto insurance plan for teens as well as college pupils should certainly consist of the following crucial coverages:: This offers insurance coverage if the chauffeur triggers an accident that hurts another person or problems their building. insurance companies. Responsibility is required in a lot of states.: This provides coverage if the vehicle driver is in a mishap with somebody that is not insured.

business insurance insurance car insured vehicle

business insurance insurance car insured vehicle

Car insurance will certainly not cover the cost of maintenance or repair work associated to deterioration. An insurer may, nevertheless, provide optional roadside help protection, which can aid a driver in an emergency situation such as having a blowout or dead battery. Who Can Purchase Auto Insurance Policy for Teens and University Student? Automobile insurance for teenagers and university student can be acquired by the majority of certified vehicle drivers.

Some of the companies in our study required a chauffeur to be 18 to buy coverage, others required a chauffeur to be only 16. insurance company. Just How to Get Vehicle Insurance Coverage for Your Teenager or as a Young Chauffeur Asking for quotes from at the very least 3 different insurer is an excellent way to find a policy that offers the most effective worth for your demands.

These agents are acquainted with multiple insurance companies, consisting of smaller sized, local choices, as well as they may be able to make recommendations along with aid you contrast insurance coverages so you can select a policy that's the finest fit for you as a young motorist (low cost auto). Keep in mind to mention any kind of variables that may aid you qualify for price cuts, like whether you have actually taken driver training, if you're intending to participate in college away from house, and if your grades are excellent.

Getting involved in an accident, specifically if you're at mistake, will likely cause greater rates in the future. Some firms, such as Allstate and also Farmers, may provide mishap mercy that stops a crash from raising your rates. USAA, GEICO as well as State Ranch may offer the least expensive rates if you have not remained in a crash or have remained in one at-fault accident.

Ideal Car Insurance Policy Rates for Young Drivers, As anybody that's included a teenager to their vehicle insurance can tell you, young chauffeurs have a tendency to be pricey to guarantee. Rates go down as you age, and also can level out once a driver is in their mid-20s. If you're a young person (or somebody covered by your plan is), you may intend to purchase new quotes after every birthday.

Great American Insurance Group - Specialty Property ... - An Overview

Among the extra traditional insurance policy companies, USAA, State Farm as well as GEICO might provide the cheapest prices - auto insurance. But commonly, there won't be a big distinction unless you choose a usage-based plan. Finest Vehicle Insurance Policy Prices Based Upon Your Credit history, In the majority of states, credit-based insurance ratings can be a factor in identifying your auto insurance coverage premiums.

At a minimum, most states require vehicle drivers to have obligation insurance coverage, which spends for others' medical expenses and damage to their property. You might additionally need to buy clinical insurance coverage or accident defense, which can help spend for your (and also your travelers') treatment. If you want protection in instance your car is damaged or swiped, you'll need accident coverage (for damages from mishaps) as well as detailed coverage (for burglary and damage triggered by something various other than a crash, such as a storm).

It's a tradeoff as more insurance coverage and also lower deductibles also lead to greater costs. Just how to Get the very best Rates on Your Cars and truck Insurance Despite which sorts of protection, limits and also deductibles you pick, there are a few ways to conserve money on car insurance coverage: There's no insurance business that offers the finest rate for everyone.

You will not always discover a cost savings possibility, but the elements that identify your prices, your insurance coverage requires as Article source well as the business' offering as well as choices can all transform with time.

Corpus Christi, TX "If you're needing insurance policy - affordable car insurance. Haven't had insurance policy for some time, after that Direct is where you require to go." E&E Wilburn Nashville, TN.

That's why it is essential to do your study and contrast your options when selecting the ideal vehicle insurance provider for your needs. As soon as you have an idea of what your costs may be from a couple of various firms, after that you can look at facets that set specific vehicle insurance provider in addition to others, like auto insurance coverage attachments or consumer fulfillment scores.

The Definitive Guide to The Best Cheap Car Insurance Companies Of 2022 - Business ...

Access, automobile claims satisfaction, price, as well as the business's monetary health are all key elements we consider in our referrals. While no single cars and truck insurance provider will certainly be the most effective for every single individual, we think these are the ones to take into consideration when in the market for auto insurance policy. To determine our picks for the very best automobile insurance coverage firms, we started with a list of 25 of the biggest cars and truck insurer by costs accumulated, based upon data from the National Association of Insurance Coverage Commissioners.

We dismissed any company that does not have A.M. car insurance. Ideal's rating of A+ or higher. We also got rid of any kind of business that are associated with any type of energetic scams examinations. Our Picks for the Finest Vehicle Insurance Provider Company Overview, GEICO GEICO, the second-largest cars and truck insurance company in the nation, insures nearly 30 million automobiles, according to its internet site.

low-cost auto insurance insurers car affordable auto insurance

low-cost auto insurance insurers car affordable auto insurance

Car Insurance Policy Claims Satisfaction Study. It additionally has the cheapest typical annual costs of insurance firms on this list. This budget-friendly business doesn't use the most distinct discount rates, but it provides lots of basic discount rates for clients like financial savings for packing policies or for having more than one automobile on the plan - cheapest.