The notion that has been observed is due to a number of variables that even more solidify the situation that 16-year-olds are too young to resume duty. Listed below we note down the points that play an important function while the insurer evaluates the price of automobile insurance policy for 16-year-old chauffeurs: Age is one of lots of variables that influence the cost of car insurance policy for 16-year-old drivers - insured car.

Purchasing a less expensive cars and truck will certainly not only be affordable yet will certainly likewise help in conserving cash on car insurance policy. This is because the minimal the cars and truck's cost, the easier it will certainly be to find the components. Higher-end lorries are much more expensive to guarantee due to the fact that of the expense to fix them.

The next action is spying the most effective sort of auto insurance coverage that is best matched to your needs and encloses a teen's monetary estimate. With the enhancement of your adolescent kid, the kind of defense you need while driving or when traveling will certainly alter dramatically. While questioning just how much automobile insurance coverage is for a 16-year-old, one need to be mindful to include the cost of the added coverages that might be called for to acquire.

Residential or commercial property Damages Responsibility safeguards you from needing to pay for one more event's problems to their lorry as a result of a mishap that could have occurred - low cost. Med, Pay is one of one of the most typically utilized insurance coverages that aid in paying the medical expenses after a covered crash, no matter who was at fault.

See This Report about Finding The Cheapest Car Insurance For Teen Drivers

car insurance money cheapest auto insurance liability

car insurance money cheapest auto insurance liability

For the analysis, the 16-year-old chauffeur pays even more than double the average expense to insure a 25-year-old. Teens can anticipate the insurance coverage price to lower by 9% when they turn 17. Just how do prices vary in between a 16-year-old man as well as women drivers? We have actually talked about that sex likewise plays a prominent duty in determining the vehicle insurance coverage price in the aforementioned paragraphs.

Why do the rates vary in between men as well as females regardless of coming from the exact same age team? There was a significant difference in the costs for every of the insurer. Some offer similar premium quantities varying from $4195 to $4309 while others have a lot greater costs, with an ordinary expense of $9327 for male or female teen vehicle drivers - cheaper car insurance.

Statistically, male 16-year-olds are most likely to enter a mishap or get a speeding ticket than a 16-year old female motorist, the premium for women is approximately 16 percent less. One must be mindful as a survey of 3 of the biggest insurers located that both kids and also girls who just got their licenses can anticipate to pay an average of a whopping $5944 every 6 months. cheapest car.

There are some phenomenal situations where concession can be availed on the expensive car insurance coverage like every other insurance coverage. Different insurance provider offer lots of price cuts to balance out the high price of insurance policy for young drivers, especially the 16-year-olds that are delighted to drive (auto insurance). Below we note down some aspects that can accommodate the candidates to utilize the discount deluxe.

Not known Incorrect Statements About How Much Does It Cost To Add A Teenager To Car Insurance?

The superb trainee category includes students that have a grade point average of 3+ and have actually been advised by their education institute. Nevertheless, the pupils have to be mindful that discount rates are readily available. Insurer also supply adolescent drivers with a telematics driving tracker, which decreases the prices after showcasing obligation as well as showing that you drive securely.

The following benefit is availed by the geographically distant trainees from their residences. University student or 16-year-old high schoolers that are much more than 100 miles far from home for institution qualify Additional info to have their insurance rates decreased. The teen driver can obtain a price cut on their automobile insurance from most insurance firms by paying for the whole strategy in complete, as opposed to breaking the price up by month (credit score).

It is always good to think about just how a claim will certainly impact your prices. Some insurance firms increase the yearly price by a monstrous quantity of $670 annually if you are at fault for a mishap - car. The insurance process is strenuous as well as complicated, and it can be valuable to determine the cost.

Most inexpensive cars and truck insurance policy for a 16-Year-Old Here we have put together a checklist of the least expensive vehicle insurance coverage that can be availed by a 16-year-old who wishes to buy auto insurance - auto insurance. While reviewing which insurance one desires to acquire, we have to determine which insurance coverage business supplies the economical premium quantities. $1193 six-month premium or $199 each month.

Not known Incorrect Statements About How Much Is Car Insurance For A 16-year-old ... - Financebuzz

It is relevant to mention that the insurance rates above are for minimum coverage. cars. One should take into consideration how much coverage they may need and also the insurance deductible they are prepared to pay without any type of economic situation.

Just how to get the very best cars and truck insurance policy for 16-year-old chauffeurs Getting the finest auto insurance for a 16-year-old is essential given that it guarantees security and also financial security. Although auto insurance policy for teenagers can be costly, you can usually locate options to fit your spending plan without compromising protection. One of the finest methods to do this is to shop around as well as get quotes from numerous insurance business.

While looking for a cars and truck insurance coverage plan, one must be interested in thinking about readily available protection types, price cuts, client satisfaction ratings, and also financial stamina. Comparing these factors, along with rate, could assist you find protection that fits your requirements. Website traffic stats for 16-Year-Old chauffeurs Adolescent vehicle drivers have a tendency to cost more to insure since they are most likely to enter mishaps as well as have a factor to utilize their insurance policy.

According to data for police-reported crashes, motorists aged 1617 were involved in almost double the variety of deadly accidents than 18- and also 19-year-olds for each 100 million miles driven. The young motorists behind the wheel are at a higher danger for mishaps. As well as there are less deaths per head for teens than for older drivers.

Some Known Details About Teens Shopping For Auto Insurance

automobile perks credit perks

automobile perks credit perks

At the age of 17, the insurance coverage is not as expensive as it is for a 16-year-old, yet still, it is a substantial quantity. car. The nationwide annual average price for a 17-year-old is simply over $5,370 for complete insurance coverage and $2,206 for minimum protection. Besides Hawaii, North Carolina has the most affordable average yearly price for a full-coverage policy for a 17-year-old at simply under $2,660.

Louisiana has the highest typical complete protection rates for 17-year-olds Can young adults have their auto insurance coverage? Teenagers are minors, and as a result of the truth they are underage, they generally are not enabled to have their cars and truck insurance coverage policy. But, they will certainly be provided as chauffeurs on their parent or guardian's policy.

However, it can be economically valuable to stay on a moms and dad or guardian's policy till they relocate out and establish their house. Conclusion The lower line of the argument is that the price of your cars and truck insurance coverage will certainly depend upon where you live and whether you obtain your plan or have your name included in a parent's plan.

If the adolescent driver does not intend to wait, they can get contributed to their parent's insurance plan - cheapest auto insurance.

Top Guidelines Of Best Car Insurance For Teens And Young Drivers For April 2022

prices auto insurance accident low-cost auto insurance

prices auto insurance accident low-cost auto insurance

The price tends to increase by a standard of $800 per year, recent information recommends., what factors effect insurance coverage expenses, and also how to save on insurance coverage prices.

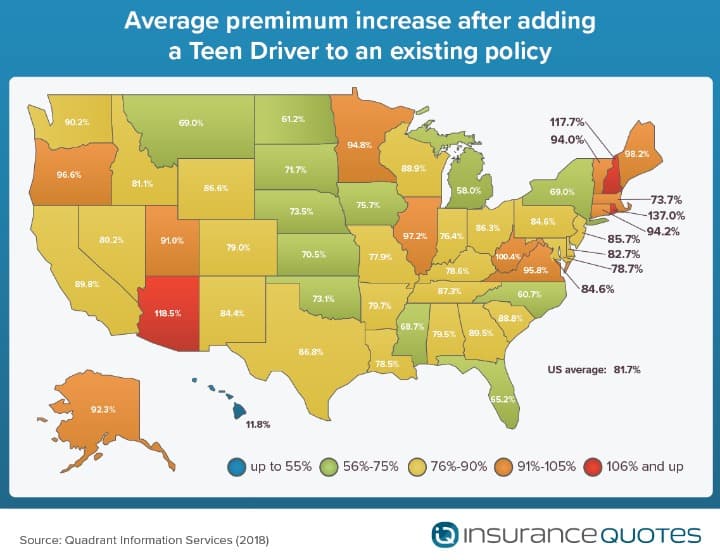

The price to include a teen onto an insurance plan can be high as a result of absence of driving history and experience, but it likewise varies based upon several aspects. Adding teenagers to a parent's policy, sharing a vehicle, and preserving great grades can all help reduced automobile insurance expenses for young people.

Usually speaking, auto insurance immediately encompasses young drivers. If a young driver is in a vehicle mishap, after that the lorry proprietor's policy will cover the loss. Some insurance policy carriers are more stringent. They want the allowed driver to be provided on the plan in order to be secured. To understand what your insurance policy carrier needs, call as well as talk with your vehicle insurance coverage representative.

Having a teen on an insurance coverage plan is expensive, a lot of states call for all motorists within a home to have vehicle responsibility insurance coverage before they can lawfully drive. By having auto obligation insurance, every person operating the vehicle will be secured for clinical, car repair, as well as other costs when the policyholder is at mistake in a mishap.

About Adding A Teen To Auto Insurance In Michigan Raises Premium ...

When licensed, you will certainly after that most likely be spoken to by mail, telling you it's time to include the motorist to the policy. Just How Much It Costs to Insure a 16-Year-Old Figuring out the cost of car insurance policy for any kind of one individual is very hard to do.

Many states need every vehicle driver when driving to have car insurance policy, and also the charges and also charges for refraining so will vary. A teenager can be covered by their parents or guardians' policy, or they can acquire your own. Though, it is extra cost reliable for a young adult to be on their house's insurance policy.

Firms think about the number of years you've gotten on the roadway, your crash as well as offense background, and also the place of where your cars and truck is normally parked. With a young individual on your plan, the cost frequently comes to be far more costly. Naturally, a chauffeur's experience has a huge effect on one's policy (credit score).

Teens are thought about to have a high risk of suing. It is necessary to keep in mind that most insurance firms usually request for your gender to determine your family price - auto. Research study suggests that, in general, men are more probable to drive under the impact, enter into vehicle crashes and also, particularly, get involved in severe vehicle accidents.

The Ultimate Guide To Adding A Teenage Driver To Your Auto Insurance Policy

Still, lots of people think really feel that private habits is a better sign of an individual's risk than their sex identification. car insurance. Great vehicle driver status can just be gained with time. Prices can come down incrementally over time, depending on your insurance coverage provider, however age 25 is when insurance coverage prices often tend to go down significantly.

Below, you'll locate the mistakes they most typically make.: A nervous driver may focus as well much on the automobile in front of them. Teens have a tendency to have passage vision and stare straight in advance, missing out on potential threats like pedestrians and animals.: Sidetracked driving can be as unsafe as impaired driving.

Examining these common errors with your teenager can aid them be a safer chauffeur. The cars and truck you pick for your teenager driver likewise affects your insurance coverage prices.

Ways to Conserve Cash on Teenager Automobile Insurance coverage While auto insurance policy for teenagers can be costly, there are a couple of methods to conserve. Several insurance coverage firms lay out tips, in addition to offers, that might be advantageous when your young adult needs to take into consideration automobile insurance. Taking place a Moms and dad's Policy Rather than obtaining their very own plan, it's normally best for a teen to be included to a moms and dad's policy.

Get This Report on How Much Is Car Insurance For A 16 Year Old?

Sharing an Automobile Having fewer vehicles under one plan than drivers is a substantial money saver. Several vehicle insurance coverage providers will certainly permit the teenager to be included as a secondary vehicle driver. As a second driver, he or she is taken into consideration to not have primary access to an automobile, and also this can assist you pay a reduced price than the main driver.